All of us are familiar with liability insurance for our vehicles. In the event we're involved in an accident that causes property damage and/or bodily injury to a third party--and the accident is our fault--our liability limits are called into play to pay that third party. So what is Uninsured Motorist coverage? We're happy to explain!

This vital coverage applies to bodily injury to YOU, in the event you're injured in an auto accident caused by a motorist with no insurance--or insufficient limits of insurance. Here are some examples. Let's say you're seriously injured in an accident caused by the other driver, and your injuries are severe enough to run up a medical bill of $50,000. The at-fault driver was only carrying a limit of $25,000 per person; your Uninsured Motorist coverage would then respond to pick up the remaining $25,000. Or, you and your family are driving to your favorite eatery, and you're suddenly rear-ended by a motorist with no insurance. All of you sustain various injuries requiring medical attention. Your Uninsured Motorist coverage would pay for the medical costs.

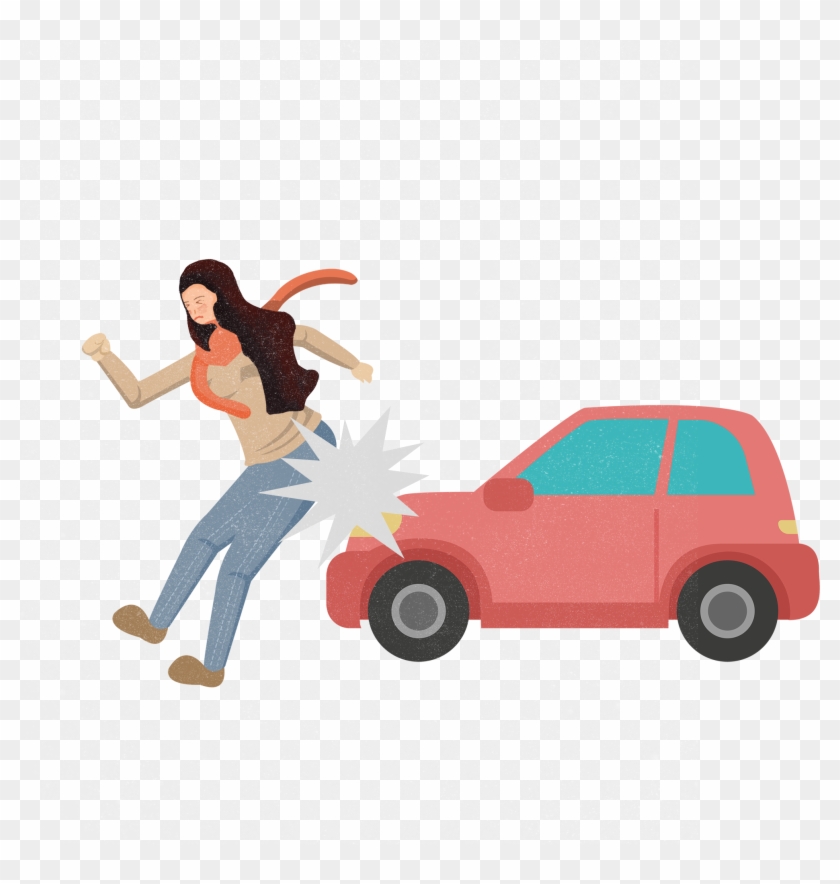

But. . .you don't even have to be in a car! If you're walking down the street, and a passing car unexpectedly loses control, jumps the curb, and strikes you, Uninsured Motorist pays for your injuries (in the event the driver has no insurance, or is underinsured). As you can see, Uninsured Motorist is your friend! Many studies suggest up to one quarter of all drivers have no insurance. For this reason, we strongly recommend you carry Uninsured Motorist on your policy, and at the highest limit you can afford.